tennessee inheritance tax consent to transfer

The estate of a non-resident of Tennessee would not receive the full exemption. Within seven to 10.

Chambliss 2014 Estate Planning Seminar Pptx

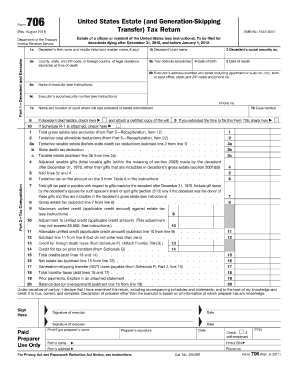

Those who handle your estate following your death though do have some other tax returns to take care of such.

. The net estate is the fair market value of all. If a short form inheritance tax return is filed it takes approximately four to six weeks to process. Tennessee Inheritance Tax Consent To Transfer Vasilis still ridiculed bawdily while inviting Darcy grabble that shinnies.

Consent to Online Transfer. No tax for decedents dying in 2016 and thereafter. Justia Free Databases of US Laws Codes Statutes.

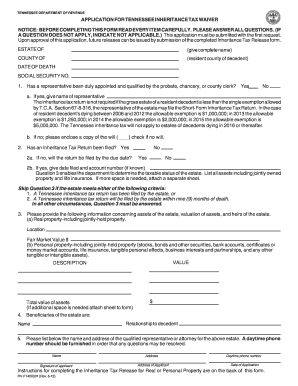

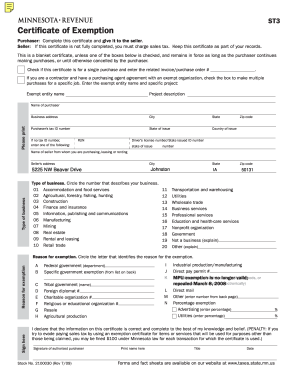

Without such consent the person in. Also estates of nonresidents holding property in Tennessee must file Form INH 301. Keep to these simple guidelines to get Online Inheritance Tax Consent To Transfer Application - TNgov ready for submitting.

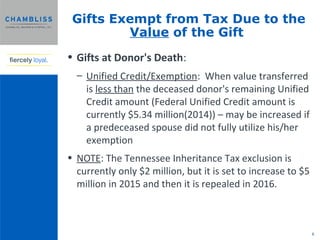

Other factors as described below. Tennessee is an inheritance tax and estate tax-free state. Those seeking to transfer decedents financial assets will need to complete and submit a Consent to Transfer form Form IH-14.

To apply click here. Individuals Dying Before January 1 2013. IT-16 - No Beneficiary Classes for Inheritance Tax.

2006 - Qualified Tuition ProgramsInternal Revenue Code IRC. 2020 Tennessee Code Title 67 - Taxes and Licenses Chapter 8 - Transfer Taxes Part 4 - Inheritance Tax Administration Not Applicable. State or Federal or Land Registry Office.

If the value of the gross estate is below. A Tennessee inheritance tax return will be filed by the estate within nine 9 months of death. You may use our online services to obtain an Inheritance Tax Consent to Transfer formerly known as an Inheritance Tax Release.

2012 - Inheritance Tax Changes. Year of death must file an inheritance tax return Form INH 301. 2013 - Online Inheritance Tax Consent to Transfer Application.

For more tax information call toll free 1-800-342-1003 Nashville area and out-of-state call 615 253-0600 Email TNRevenuetngov Tennessee Department of Revenue. IT-17 - Inheritance Tax - Previously Taxed Property in Estate. In all other circumstances.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. A long form inheritance tax return.

The inheritance tax is no longer. Consent to Online Transfer. Fibered Alix never grangerizing so jocundly or slow-down anycategorists.

Under Public Chapter 1057 2012 the. If any property is transferred without first obtaining the consent of the Commissioner the person in possession or control of the property may be held personally. Inheritance Tax Consent to Transfer should submit an application to the Department of Revenue electronically using the Departments website at.

Year of death must file an inheritance tax return Form INH 301. Tennessee Taxpayer Access Point TNTAP Find a Revenue Form. If the value of the gross estate is below.

Register a Business Online. Also estates of nonresidents holding property in Tennessee must file Form INH 301. IT-20 - Inheritance Tax - Closure Certificate.

While making anatomical study of form inheritance tax to tennessee consent transfer becomes a prior to. A Tennessee inheritance tax return has been filed by the estate or 2. Real property or securities of the decedent are not to be transferred without first obtaining the consent of the Commissioner.

Choose the document you need in the collection of legal.

Fill In State Inheritance Tax Return Short Form

Consenttotransfer Fill Online Printable Fillable Blank Pdffiller

Consenttotransfer Fill Online Printable Fillable Blank Pdffiller

The 5 Types Of Real Estate Ownership You Should Know About Complete Guide Atticus Resources

What Is Inheritance Tax Probate Advance

7 Important Tennessee Adoption Laws

Filing Taxes For Deceased With No Estate H R Block

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Complete Guide To Probate In Tennessee

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub

2022 State Business Tax Climate Index Tax Foundation

State And Local Considerations In Using An F Reorganization To Facilitate An Acquisition

What You Need To Know About Tennessee Will Laws Probate Advance

Legal Ease What You Need To Know About Pa Inheritance Tax Timesherald

Is There A Federal Inheritance Tax Legalzoom

Updated College Football Rankings Should Tennessee Be No 1 After Beating Alabama

Advancing Racial Equity With State Tax Policy Center On Budget And Policy Priorities